How To Do Bank Reconciliation For Your Business

Content

- Company

- How Do You Reconcile A Bank Statement?

- Example #4 Of Bank Reconciliation Statement Template

- Examples Of Bank Reconciliation

- Step 2: If They Dont Match, Identify Transactions That Are Causing The Differences

- Challenges With Bank Reconciliations

- Why Is Bank Reconciliation Important?

- How To Do Bank Reconciliation For Your Business

A check that a company mails to a creditor may take several days to pass through the mail, be processed and deposited by the creditor, and then clear the banking system. Therefore, company records may include a number of checks that do not appear on the bank statement. These checks are called outstanding checks and cause the bank statement balance to overstate the company’s actual cash balance. Since outstanding checks have already been recorded in the company’s books as cash disbursements, they must be subtracted from the bank statement balance.

For example, the bank may mistakenly record a $570 deposit instead of a $750 deposit. This always results in an error that is a multiple of nine ($180 in this example). Contact your bank and ask them to make a correction to remove the reconciling item. The bank statement balance would need to be credited to reflect the true amount of cash. If an item appears only in one place , it is a “reconciling item”.

Company

The checks Fender received from customers won’t actually appear in Fender’s bank account until they are cashed and the bank clears them. One of the four checks, made out for $1,000, that was written that month remains uncashed and is missing from the bank statement.

- Reconciliation software utilises robotic process automation to carry out the reconciliation like a human being would, but without the need for any manual labor.

- Petty cash is a small amount of cash on hand used for paying expenses too small to merit writing a check.

- By reducing manual human inputs and adopting automatic mapping, you may reduce errors.

- The account reconciliation process should not take weeks or months to complete.

- Automation tools will carry out flux analysis for you so you can spot mistakes in real-time.

- If you voided it with the bank, the bank should reject the check when it is presented.

- “Very nice. This has helped me in preparing the reconciliation of my bank statement. Thank you.”

You don’t typically know about interest your account has earned until a bank statement arrives. Add any interest the bank has credited to your cash account balance. Until you post the interest to your records, the amount is a reconciling item.

How Do You Reconcile A Bank Statement?

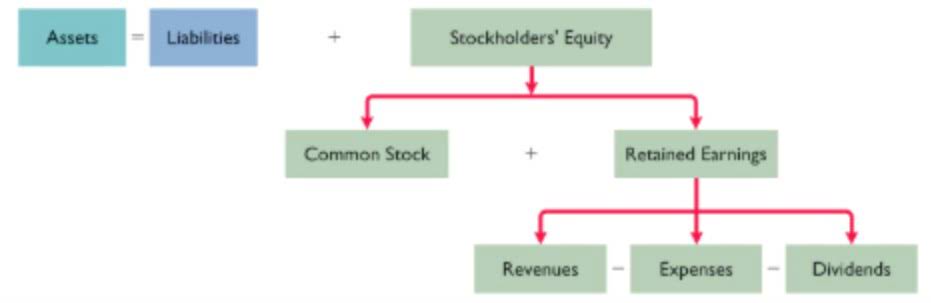

They spot discrepancies and bring the two cash amounts into alignment by adjusting for as-yet unrecorded transactions, such as deposits that have not yet cleared the banking system and new bank fees. Bank reconciliations are an important tool in cash-flow management and are usually handled by an accounting department or a business owner. The first is comparing the cash balances and transactions on the company’s books to the cash balances and transactions listed on an external bank statement.

An example of one such error would be a returned check recorded as $50 but is actually in the amount of $60. Bank errors, when corrected, effect the adjusted balance of company records. If so, these entries will not appear in the bank reconciliation statement prepared at the end of the current month. The need and importance of a bank reconciliation statement are due to several factors.

Also, check for any miscellaneous deposits that haven’t been accounted for. Once you’ve located these items, you’ll need to adjust the G/L balance to reflect them. The bank reconciliation definitionis the settlement of records between the balance per company financials and the balance per the bank statement. The process of accounting bank https://www.bookstime.com/ statement reconciliation is essential because of the many timing differences and errors in the recording process between two parties. When effectively implemented it assures that the bank as well as the business have relevant financial statements. In general, it’s good practice to perform bank reconciliations at the end of each month.

Bank reconciliation statements safeguard against fraud in recording banking transactions. They also help to detect any mistakes in cash book and bank statement. For instance, if you haven’t reconciled your bank statements in six months, you’ll need to go back and check six months’ worth of line items. Whether this is a smart decision depends on the volume of transactions and your level of patience. We’ll go over each step of the bank reconciliation process in more detail, but first—are your books up to date?

Example #4 Of Bank Reconciliation Statement Template

A check previously recorded as part of a deposit may bounce because there are not sufficient funds in the issuer’s checking account. The Vector Management Group’s bank statement includes an NSF check for $345 from Hosta, Inc.

She creates a bank reconciliation statement that itemizes both the $200 in unrecorded bank fees and the $13,000 in outstanding deposits. The first step in reconciling a bank statement is to compare financial record activities to bank statement activities. For any bank errors, unaccounted for deposits, and unpresented checks, make adjustments to the bank statement balance. Some personal or business accounts do not account for bank-related additions and charges, such as interest and maintenance fees. Make adjustments to the cash account records for these differences. Once corrections and adjustments are made, compare the balances to see if they match. If not, repeat the process until the accounts are reconciled.

- Below is a video explanation of the bank reconciliation concept and procedure, as well as an example to help you have a better grasp of the calculation of cash balance.

- – Now, you’ll need to match the deposits in your records with the transactions listed on your bank statement, making sure that each deposit is listed in your accounts as income.

- A check that was not honored by the bank of the entity issuing the check, on the grounds that the entity’s bank account does not contain sufficient funds.

- Performing a bank reconciliation regularly can drastically reduce the amount of errors that can occur in an accounts system and makes it easier to find absent purchase and sales invoices.

- If they are still unequal you will need to repeat the process in order to find the error.

If a cash deposit is made at the end of the day, the money may not show up in the company’s bank account until the next day. Other delays — including a check that is mailed or still sitting at the recipient’s office — also cause deposits in transit. The cash balance on a company’s books almost never matches the bank statement balances at the end of the month. Bank reconciliation ensures that your business’ cash balance is what you thought it is.

Examples Of Bank Reconciliation

These are items on the bank statement that are not recorded in the general ledger, and are shown as adjustments only. Cross-check the returned checks from What is bank reconciliation the bank with the bank statement to ensure that all checks have been returned. If there are errors on the bank statement notify the bank immediately.

- To understand the step-by-step guidelines on how to prepare a bank reconciliation statement from scratch, read our blog on ‘A Beginner’s Guide to a Bank Reconciliation Statement Preparation’.

- There may also be collected payments that have not yet been processed by the bank, which requires a positive adjustment.

- There are several steps that are involved in this, but, even so, it is a relatively simple thing to do.

- Interest earned by the depositor and paid by the bank of $55.

- Furthermore, your team can focus on more creative tasks, which often ends up resulting in increased employee satisfaction.

– First up, you’ll need to get a record of transactions from the bank. You can find this on your bank statement, through online banking, or by asking the bank to send this data directly to your accounting software. One way to become familiar with the process of bank reconciliation is to work through a basic example.

Step 2: If They Dont Match, Identify Transactions That Are Causing The Differences

Since these items are generally reported to the company before the bank statement date, they seldom appear on a reconciliation. When you “reconcile” your bank statement or bank records, you compare it with your bookkeeping records for the same period, and pinpoint every discrepancy. Then, you make a record of those discrepancies, so you or your accountant can be certain there’s no money that has gone “missing” from your business.

This is done to confirm every item is accounted for and the ending balances match. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations. Reconciling bank statements helps to identify errors that affect tax reporting. Without reconciling, companies may pay too much or too little in taxes. Another possibility that may be causing problems is that the dates covered by the bank statement have changed, so that some items are included or excluded.

With all the benefits of bank reconciliation and the risks of neglecting the task, there’s truly no excuse for any business to let accounts go unreconciled. Here’s a video from QuickBooks that explains the bank reconciliation process if you want to learn more. The primary reason for frequent account reconciliation is to keep close tabs on cash flow. Whether you use the cash or accrual accounting method, bank reconciliation reveals exactly how much cash you have flowing into and out of your business at any given moment. We say “almost” because even without separation of duties, there are still lots of reasons to reconcile bank accounts. Not separating duties, however, means your business is vulnerable to inconsistencies, overlooked mistakes, and even worse, potential for fraud. The individual responsible for entering information should not be the same person who reconciles the accounts.

After these adjustments, the adjusted balance per the bank is $6,975 ($5,975 + $2,000 – $1,000). As noted in the preceding special issue, if a check remains uncleared for a long time, you will probably void the old check and issue a replacement check. If you voided it with the bank, the bank should reject the check when it is presented. If you did not void it with the bank, then you must record the check with a credit to the cash account and a debit to indicate the reason for the payment . If the payee has not yet cashed the replacement check, you should void it with the bank at once to avoid a double payment. Otherwise, you will need to pursue repayment of the second check with the payee. Check off in the bank reconciliation module all deposits that are listed on the bank statement as having cleared the bank.

While this will cause a discrepancy in balances at the end of the month, the difference will automatically correct itself once the bank collects the checks. In the case of items in transit, these arise from several circumstances.

- Your bank reconciliation form can be as simple or as detailed as you like.

- Either way, it means the money doesn’t end up in the check recipient’s account.

- This shows a record of each transaction in your account for a specified time period.

- An item-by-item bank reconciliation reveals fraudulent activity quickly.

- A credit memorandum attached to the Vector Management Group’s bank statement describes the bank’s collection of a $1,500 note receivable along with $90 in interest.

Day of the following month, and then approved by the Controller. At the bottom of your spreadsheet for February, add this note, tracking changes to your balance. Online bookkeeping and tax filing powered by real humans. A note receivable amount of $2,500 was collected by the bank on behalf of the business.

Challenges With Bank Reconciliations

Bank Reconciliation Software Application increases internal controls by allowing organizations to see how the process works and feel confident that it is always running smoothly. It also prevents any activities that aren’t part of the process, and alerts may be set up for any unusual changes or activities.

Why Is Bank Reconciliation Important?

After looking at company policy, she prepares some procedure changes which should prevent the company from sending non-collectible checks. This is an important fact because it brings out the status of the bank reconciliation statement. A bank reconciliation statement is only a statement prepared to stay abreast with the bank statement; it is not in itself an accounting record, nor is it part of the double entry system. The bank statement submitted by the businessman at the end of May will not contain an entry for the check, whereas the cash book will have the entry.

Debits and credits are reversed in bank statements–compared to business accounting records–because the bank is showing the transactions from its perspective. Many accounts may have automatic monthly payments set up for certain recurring bills. If you don’t have the payment date for auto payments on your calendar, you may not see the withdrawal until it appears on the monthly bank statement. Post any missing automated debit payments to your cash account.

Where there are discrepancies, companies are able to identify the source of errors and correct them. The accountant adjusts the ending balance of the bank statement to reflect outstanding checks or withdrawals.